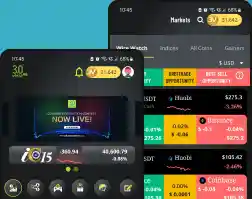

Trade across top Crypto Exchanges through a single dashboard

Connect your crypto wallets to track, buy, sell, swap, and borrow digital assets

Access to 3000+ crypto currencies across top multiple exchanges

Compare crypto prices across multiple exchanges for best Bid - Ask

Swap/Lend/Borrow from a single dashboard

Multiple AI driven bots trading on top crypto currencies