BOT Trading

In the fast-paced world of cryptocurrency trading, having a competitive edge can make all the difference. Imagine having an intelligent assistant that analyzes market trends, executes trades, and maximizes your profits – all while you focus on what matters most. Welcome to the future of trading: AI Bot Technology.

Our AI Bot is not just another trading tool – it's a strategic partner that leverages the latest advancements in artificial intelligence and machine learning. With real-time data analysis and predictive capabilities, our AI Bot identifies opportunities, mitigates risks, and adapts to changing market conditions with unparalleled precision.

Bot trading, also known as algorithmic crypto trading or automated trading, refers to the use of computer programs (crypto trading bots) to execute trading strategies in crypto markets.

- Speed and Efficiency

- 24/7 Availability

- Elimination of Emotions

- Diversification

- Data Analysis

- Access to Complex Strategies

Algorithmic trading, commonly referred to as bot trading, utilizes computer programs (bots) to implement predetermined trading strategies within financial markets. These bots analyze real-time market data, historical patterns, and technical indicators to make automated trading decisions. By operating without human intervention, bot trading offers unparalleled speed, executing trades instantly and capitalizing on rapid market fluctuations. It eliminates emotional biases, ensuring consistent and disciplined trading. Bots can operate 24/7, capturing opportunities across different time zones and reacting swiftly to news events. They excel in precision, risk management, and backtesting, enabling traders to refine strategies before deployment. However, bot trading comes with risks, including technical challenges and potential losses from poorly designed strategies. Properly utilized, bot trading offers a powerful tool to diversify portfolios, optimize trading, and reduce stress associated with manual trading, revolutionizing the way financial markets are navigated, including binance trading bot.

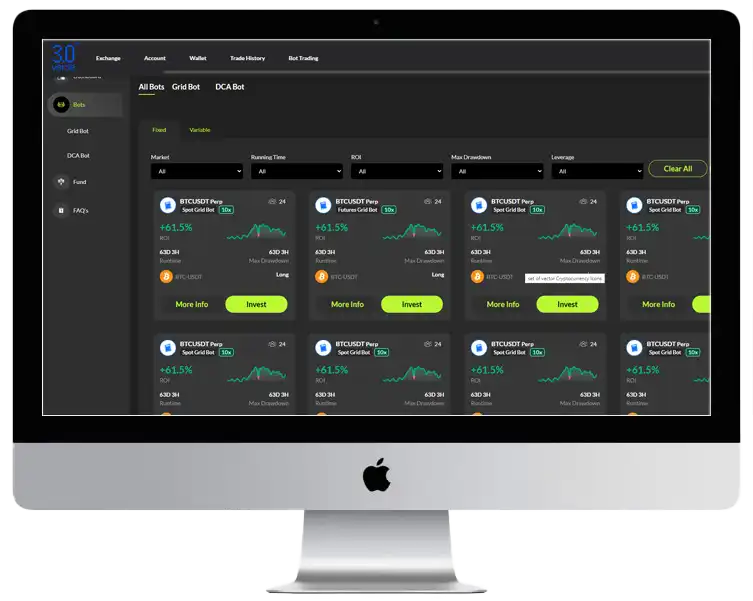

Bot Trading

Automated trading, choose the expected returns and risks you are willing to take , Smart AI driven bot will take care of the rest

Strategy Development

Traders or developers can define trading strategies by defining specific rules, conditions, and criteria that the bot will follow. These strategies can be based on various factors such as price movements, volume, moving averages, and other technical indicators in the realm of crypto bot trading and crypto trading algorithm.

Data Analysis

Bots can process and analyze large volumes of data quickly, allowing them to identify potential trading opportunities or trends that might be difficult for a human trader to spot in the context of crypto trading bot and algorithmic crypto.

Execution Speed

One of the advantages of bot trading is its ability to execute trades at very high speeds. Bots can place orders in milliseconds, taking advantage of small price discrepancies or fleeting opportunities in the world of crypto bot trading.

Risk Management

It provides risk management features to help control potential losses in the realm of crypto trading bot. These may involve setting stop-loss orders, position sizing, and other parameters to ensure that losses are limited in algorithmic crypto.

Backtesting

Before deploying a trading strategy in real-time, traders often test the strategy using historical data to assess its performance and refine its parameters in the context of crypto trading algorithm.

Minimized Human Error

Automation reduces the potential for manual errors associated with manual trading, ensuring accurate trade execution.

Grid BOT

Grid bots are automated trading algorithms which involve placing buy and sell orders at specific price levels in the world of crypto bot trading.

- Automated Grid Strategy

- Hands-Free Trading

- Backtesting

- Technical Analysis Integration

- Entry at Various Price Levels

DCA BOT

DCA bots are automated trading tools that offer an avenue for traders and investors to execute a strategy called dollar-cost averaging, which involves making regular fixed-dollar investments at predefined intervals, regardless of the asset's price in the context of algorithmic crypto.

- Automatic Averaging

- Cost Averaging

- Long-Term Focus

- Low Barrier to Entry