Multi Lending and Borrowing

Experience innovative blockchain-powered lending and borrowing platforms designed to bridge the gaps present in conventional banking. Our expert team specializes in creating and delivering cutting-edge solutions that revolutionize the lending and borrowing in defi landscape.

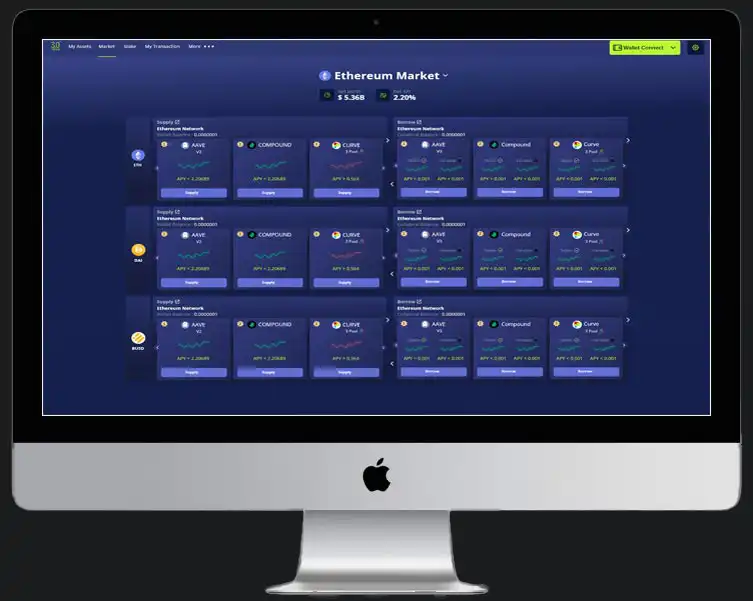

- Explore Ethereum, Polygon, Avalanche, and more networks

- Access AAVE, Compound, Curve, and more in one place

- Monitor transactions and holdings effortlessly

- View transaction status with 'View on Explorer'

- Enjoy seamless interactions with a user-friendly design

The DeFi sector gained substantial traction throughout 2020, and by April 2021, the DeFi market had amassed a total value exceeding USD 61 billion. Among the significant drivers of this impressive value is the domain of DeFi lending and borrowing. Embrace the Power of 3.0Verse: Offering an expansive and immersive crypto lending platform experience across a diverse range of top-tier ecosystems, including Ethereum, Polygon, Avalanche, Arbitrum, Optimism, Fantom, Ethereum AMM, and Harmony. Seamlessly navigate the dynamic landscape of decentralized finance through our comprehensive platform for lending and borrowing crypto.

Enterprises and startups worldwide are seizing the opportunity to tap into the multi-billion dollar DeFi market by launching their own DeFi lending and borrowing software solutions. Whether you are an emerging startup or an established firm looking to ride the crest of the next DeFi lending wave, Antier Solutions stands ready to guide you through your journey in the world of peer to peer crypto lending and blockchain lending platforms.

We chart a comprehensive path to develop a DeFi lending platform that stands out with its cutting-edge features. Our prowess in blockchain technology, financial understanding, and IT management uniquely positions us to successfully deliver high-performance lending platforms crypto tailored to your business requisites.

Decentralization

DeFi lending and borrowing platforms operate on blockchain networks, which are decentralized and transparent. Transactions, contracts, and interactions are recorded on a public ledger, reducing the need for intermediaries like banks in the context of peer to peer lending blockchain.

Accessibility

DeFi platforms are open to anyone with an internet connection and a cryptocurrency wallet. This inclusivity allows users from around the world, including those without access to traditional banking services, to participate in the realm of peer to peer lending crypto and p2p crypto lending.

DeFi Wallet Integration

The platform incorporates a secure DeFi wallet, allowing borrowers to deposit their cryptocurrency assets for lending and lenders to provide their assets for borrowing in the world of crypto lending platform. This wallet is compatible with a wide range of tokens and stablecoins, providing flexibility for crypto borrowing and lending.

Automation and Efficiency

Smart contracts automate lending and borrowing processes in the realm of blockchain peer to peer lending. This reduces the need for manual intervention and ensures that transactions are executed according to predefined rules without the need for third-party oversight in the context of p2p lending blockchain.

AAVE Flash Loans

AAVE's standout feature, flash loans, enable users to borrow assets without collateral, as long as they repay the loan within the same transaction block. This unique feature allows for innovative financial strategies and quick capital movement within the DeFi ecosystem, including crypto loans without collateral.

24/7 Availability

DeFi platforms operate 24/7, allowing users to lend, borrow, or manage their assets at any time, without being limited by traditional banking hours. Choice of Assets: Users often have the flexibility to lend and borrow a wide range of cryptocurrencies and digital assets, enabling them to choose assets that align with their investment strategies and risk preferences in the world of best crypto lending platform.

Smart Contract

The utilization of a smart contract plays a pivotal role in achieving total platform decentralization in the realm of lending platform crypto. Operating as an automated digital intermediary, the smart contract manages fund transfers, transactions, and computations conducted within the platform, ensuring transparency and security for top crypto lending platforms.

Liquidity Provision

Lenders can earn interest on their idle assets by providing liquidity to borrowers in the context of peer to peer lending crypto. This benefits both parties and helps efficiently allocate funds within the ecosystem of crypto lending platform.

Collateralization

Borrowers are required to provide collateral, which helps mitigate risk for lenders. The use of collateral ensures that borrowers have a stake in repaying their loans.

Financial Innovation

DeFi lending and borrowing platforms are at the forefront of financial innovation, introducing new concepts and structures that challenge traditional financial models in the realm of lending and borrowing defi.

Transparency and Auditability

Transactions and activities on DeFi platforms are recorded on the blockchain, providing a high level of transparency and traceability in the world of blockchain lending platforms. Smart contracts can also be audited to verify their security in the realm of crypto lending platform.

Reduced Counterparty Risk

Traditional lending often involves counterparty risk, where a borrower may default on their loan. In DeFi, the risk is mitigated through collateralization and automated smart contract mechanisms in the context of lending and borrowing crypto.

Interoperability

DeFi platforms can often be integrated with various wallets, dApps (decentralized applications), and other services, enabling a seamless user experience across different platforms in the context of lending platform crypto.